The current low interest rate environment resulting fromthe ongoing COVID-19 pandemic may provide individuals whose estates are expected to exceed the federal estate tax exemption amounts (currently $23,160,000 for a married couple) an opportunity to benefit from certain gift planning techniques.

Grantor retained annuity trusts (GRATs) and charitable lead annuity trusts (CLATs) are trusts that provide an annuity for a specified term to the grantor (a GRAT) or to a charity (a CLAT), with the remainder at the end of the term passing to the grantor’s family or other designated beneficiaries. The annuity is determined using IRS prescribed interest rates. For May 2020 the rate is 0.8%. As contrast, the rate was 2.8% in May 2019 and 2.0% in January 2020.

Grantor Retained Annuity Trusts (GRATs)

For a GRAT, if, over the selected term, the income and growth of the transferred assets exceed the IRS prescribed interest rate, the grantor receives the amount transferred and the excess passes to the remainder beneficiaries, gift tax free.In addition, because the GRAT is structured as a grantor trust, the grantor pays all the income tax generated by the GRAT, which provides an additional gift tax free benefit. If, over the selected term, the income and growth of the transferred assets does not exceed the IRS prescribed interest rate, the grantor receives the amount transferred and nothing passes to the remainder beneficiaries. However, since there has been no gift, no part of the grantor’s federal estate tax exemption amount has been wasted. If the grantor does not survive the term, all or a portion of the GRAT is includible in the grantor’s estate, so a short-term GRAT is preferable to a long-term GRAT.

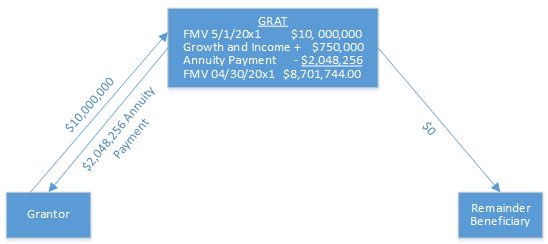

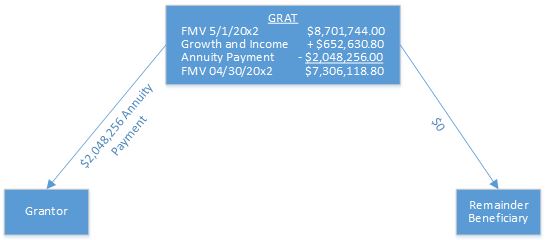

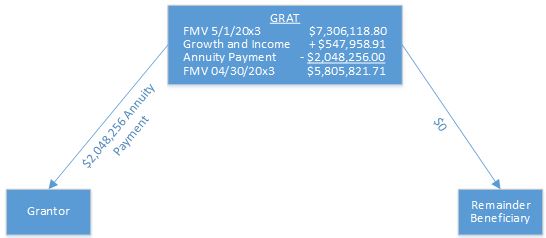

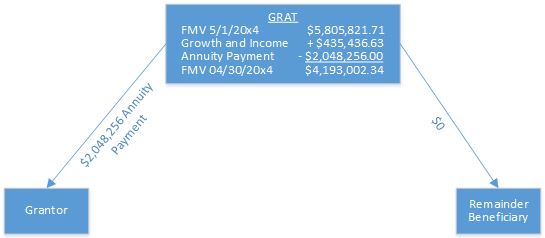

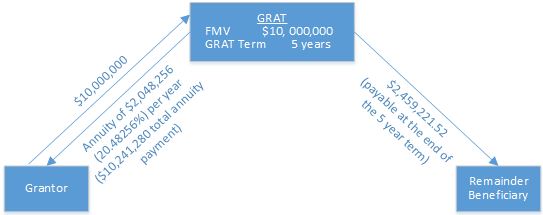

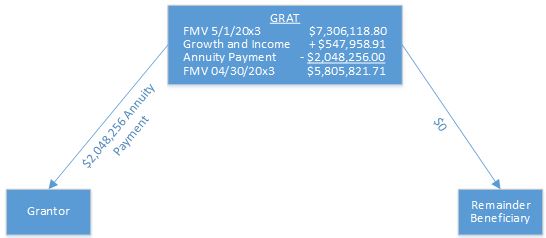

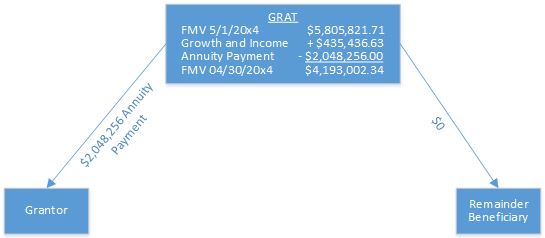

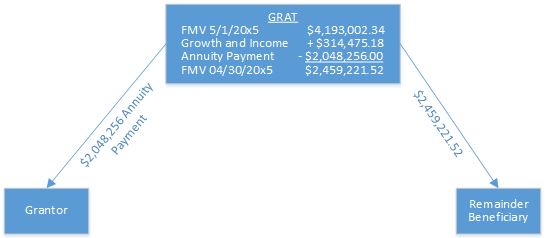

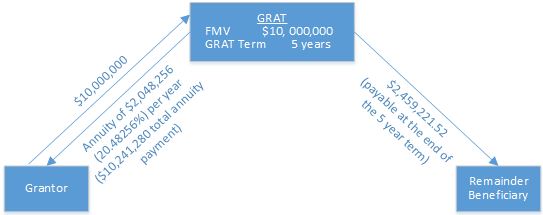

Example: Assume a gift to a 5-year GRAT of a limited liability company interest, valued at $10,000,000, is made in May 2020. The limited liability company interest generates growth and income at an annual rate of 7.5%. The remainder beneficiaries receive $2,459,221.52 at the end of the 5-year term, gift tax free, as illustrated below:

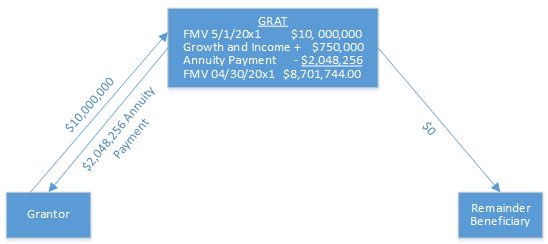

Year 1:

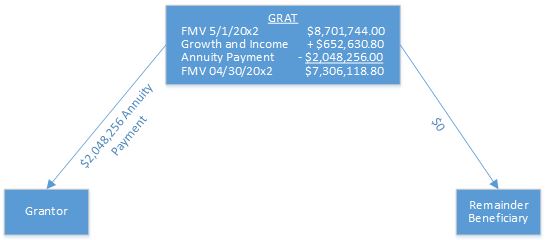

Year 2:

Year 3:

Year 4:

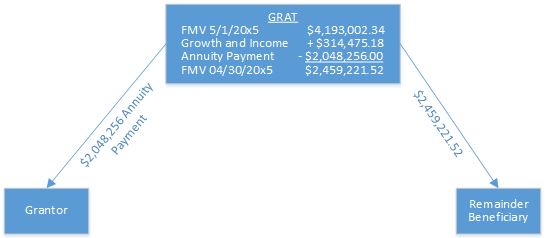

Year 5:

Summary:

Charitable Lead Annuity Trusts (CLATs)

A CLAT is similar to a GRAT except that the recipient of the annuity payments is a charity. A CLAT is a desirable vehicle for individuals with charitable goals. Depending on its design, either the grantor of the CLAT can benefit from a charitable income tax deduction in the year the property is transferred or the CLAT can benefit from the charitable deduction for the distribution it makes to charity each year. In both cases the growth and income in excess of the IRS prescribed interest rate will pass to the remainder beneficiaries gift tax free.

If you have any questions or would like further information about this matter, please contact one of the attorneys in our Estate Planning and Wealth Transfer Practice.

Related Practices