This week, the IRS issued guidance for employers claiming the employee retention tax credit for the first two quarters of 2021.1

Background: Changes Under December 2020 Stimulus Plan

Detailed in a previous Gould & Ratner article on the extension and expansion of the employee retention tax credit, the stimulus bill signed into law in December 2020 extended the timeframe in which eligible wages can be paid to July 1, 2021, and modified the calculation of the credit for qualified wages paid in 2021.

Also, as we discussed in a previous article, last month the IRS issued guidance for employers claiming the credit for 2020. The guidance did not address the extension of the credit into 2021.

Claiming Employee Retention Credit for 2021

The IRS has issued guidance to employers on how to determine eligibility, and the amount of the credit they may claim, for the first two quarters of 2021. The guidance includes the following:

- For each of the first two quarters of 2021, the maximum credit is $7,000 per employee (for a total of $14,000 per employee for both quarters)

- Whether an employer is eligible to claim the credit based on a significant decline in gross receipts is determined separately for each calendar quarter

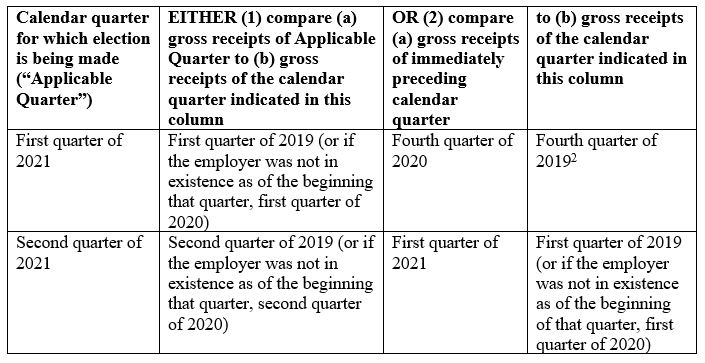

- For an employer to be eligible to claim the credit based on a significant decline in gross receipts, there must be at least a 20% decline in gross receipts, determined as follows:

- The limitation on the amount of qualified wages paid that applies for employers who had more than 100 full-time employees in 2019 claiming the credit for 2020 does not apply for determining the credit for the first two quarters of 2021

- Employers who had 500 or fewer full-time employees in 2019 (small eligible employers) may elect to receive an advance payment of the credit, not to exceed 70% of the average quarterly wages paid in calendar year 20193, but such employers still must reduce deposits in anticipation of the credit before requesting an advance

- Additional information is given pertaining to small eligible employers that are seasonal employers and employers that were in existence for some but not all calendar quarters of 2019 or 2020

If you have any questions about claiming the employee retention credit, please contact one of the attorneys in Gould & Ratner’s Tax Planning and Compliance Practice.

1The stimulus bill enacted last month extended the credit for wages paid in the third and fourth calendar quarters of 2021. The guidance issued this week does not address this extension but mentions that guidance is forthcoming.

2If the employer did not exist at the beginning of the fourth calendar quarter of 2019, the alternative quarter election cannot be used for the first calendar quarter of 2021.

3For calendar quarters in 2020, there was no restriction on the types of eligible employers that could claim an advance payment or a maximum amount other than the amount of the credit eligible to be claimed.